Managing risk is crucial for every business and organisation, from listed companies to unincorporated associations. Risk management forms part of an organisation’s broader governance framework and is a critical business practice that helps companies identify and evaluate issues, all the way to tracking and improving their risk mitigation strategies. But first, to understand risk management, we need to understand the different types of risk, positive and negative. Yes, you can have positive risks!

The International Organisation for Standardisation defines risk as “the effect of uncertainty on objectives.” (If you’re interested in the details, the specific standard is ISO 31000:2018, which provides principles and guidelines on managing risk).

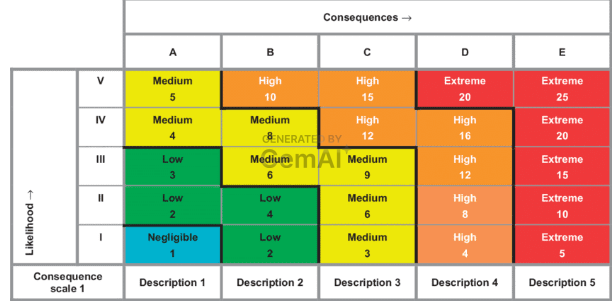

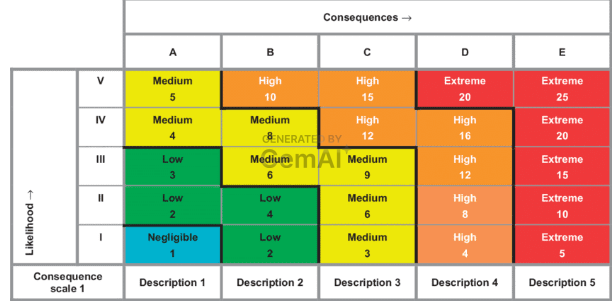

Risk management aims to tell businesses about the threats in their operating environment and allows them to retroactively and preemptively minimise or combat risk. It follows that risk management is the practice and synergy of 3 key things:

- Identification

- Evaluation

- Prioritisation

But what are the steps, and who should be involved in the process?